John Burbank, China's Man in San Francisco

A key figure in a structure of Chinese influence

John Burbank is a hedge fund manager and former hot dog salesman—like Ignatius J. Reilly—who was plugging Chinese Internet companies a decade ago, and he’s deeply involved with the Saudis. After closing his main fund, he got really into crypto, and his philanthropy backs all kinds of left-wing causes out in California, though that’s probably his ex-wife’s job.

He taught in China after college, and according to his Forbes profile is extremely unenthusiastic about the United States. When you have a guy who’s unenthusiastic about America, invests a bunch of money abroad, then gets into cryptocurrency, you start to wonder if we’re dealing with a traitor here.

One interesting thing about him is he maintained his ties with the Saudis even after the Khashoggi dismemberment. Here he is with Matt Michelsen, the weird character tied to the Texas slush funds:

In one profile of him, he reportedly spent his early investing career betting with money borrowed from his credit cards:

But he was also drawn to the investment world, and in 1994 he decided he’d take six months to trade, using money he borrowed with his credit cards. “I was interested in figuring out how the market works and the psychology of other players,” he says.

His 2010 Benzinga profile doesn’t mention how trading on $50,000 worth of credit cards actually went, just that he eventually found success.

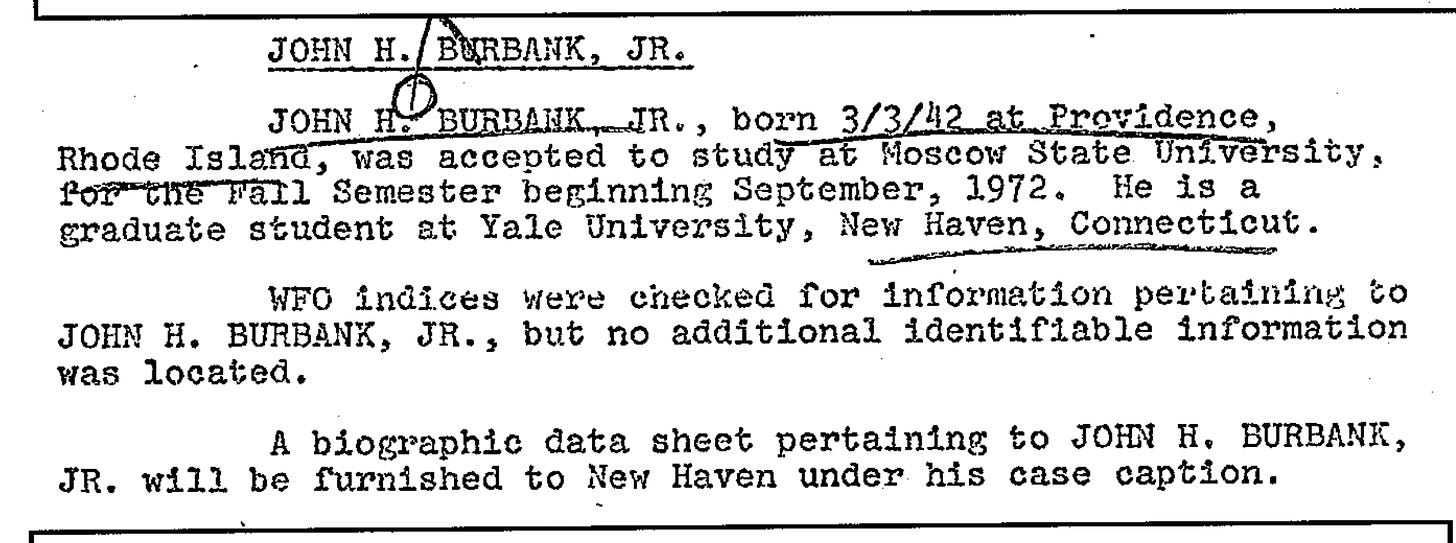

One really odd thing about this profile in Institutional Investor is that it merely says his father taught secondary school. In fact he was an expert in Russian literature, who studied in Moscow in the 1970s, and has an FBI file:

FBI headquarters granted the New Haven office permission to interview him upon his return in 1973.

The FBI appears to have been concerned that he was approached by Soviet security services, and it was made clear to students there at the time that they were expected to be watched and eavesdropped upon more or less at all times.

Now, the Burbank who’s in business today didn’t decide to go to business school until coming back from China:

What really made him want to understand business and the way the world was changing, however, was his stint teaching English in China in 1988. When he returned to the U.S., he decided that the Stanford Graduate School of Business was the perfect place to learn more. Still, after earning his MBA in 1992, he entertained various career options.

Thereafter, he starts trading on his credit card. His first big windfall comes from a SoftBank investment, according to this profile. After going to business school following time in China, and making his first big windfall from SoftBank, he really makes it big investing in China in the mid-2000s. Does it seem like this guy is more or less just constructed by the Chinese? When he closed his materials fund in 2012 it was reported that two of the major companies he was involved were Kazakh and Chinese-Canadian.

He’s also an investor in the Golden State Warriors, one of the NBA teams most prone to slavishly bending over for the Chinese Communist Party:

The Chinese have returned the favor, too, as the Warriors are considered one of the favorite American teams.

Another part-owner, Chamath Palihapitiya, a host with David Sacks and the mobster Jason Calacanis of the All-In Podcast—the best true crime podcast in the country because you can hear directly from the criminals—got into a bit of trouble in 2022 for saying nobody cares about the Uyghurs.

Some of these investors appear to be key figures in the Chinese takeover of much of California.